Other companies that might have higher ratios include those that face little competition and have strong market positions, and regulated companies, like utilities, that investors consider relatively low risk. A company’s ability to cover its long-term obligations is more uncertain, and is subject to a variety of factors including interest rates (more on that below). But if a company has meet brittany cole bush grown increasingly reliant on debt or inordinately so for its industry, potential investors will want to investigate further. When using the D/E ratio, it is very important to consider the industry in which the company operates. Because different industries have different capital needs and growth rates, a D/E ratio value that’s common in one industry might be a red flag in another.

What is your risk tolerance?

- In this guide, we’ll explain everything you need to know about the D/E ratio to help you make better financial decisions.

- A high D/E ratio indicates that a company has been aggressive in financing its growth with debt.

- The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

- The Debt to Equity ratio is a financial metric that compares a company’s total debt to its shareholder equity.

- As implied by its name, total debt is the combination of both short-term and long-term debt.

While a useful metric, there are a few limitations of the debt-to-equity ratio. These can include industry averages, the S&P 500 average, or the D/E ratio of a competitor. Some investors also like to compare a company’s D/E ratio to the total D/E of the S&P 500, which was approximately 1.58 in late 2020 (1). The general consensus is that most companies should have a D/E ratio that does not exceed 2 because a ratio higher than this means they are getting more than two-thirds of their capital financing from debt.

Current Ratio

We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own. If the D/E ratio gets too high, managers may issue more equity or buy back some of the outstanding debt to reduce the ratio.

Debt Ratio Formula and Calculation

Coryanne Hicks is an investing and personal finance journalist specializing in women and millennial investors. Previously, she was a fully licensed financial professional at Fidelity Investments where she helped clients make more informed financial decisions every day. She has ghostwritten financial guidebooks for industry professionals and even a personal memoir. She is passionate about improving financial literacy and believes a little education can go a long way. You can connect with her on Twitter, Instagram or her website, CoryanneHicks.com.

D/E ratios should always be considered on a relative basis compared to industry peers or to the same company at different points in time. It is widely considered one of the most important corporate valuation metrics because it highlights a company’s dependence on borrowed funds and its ability to meet those financial obligations. Many companies borrow money to maintain business operations — making it a typical practice for many businesses.

Is there any other context you can provide?

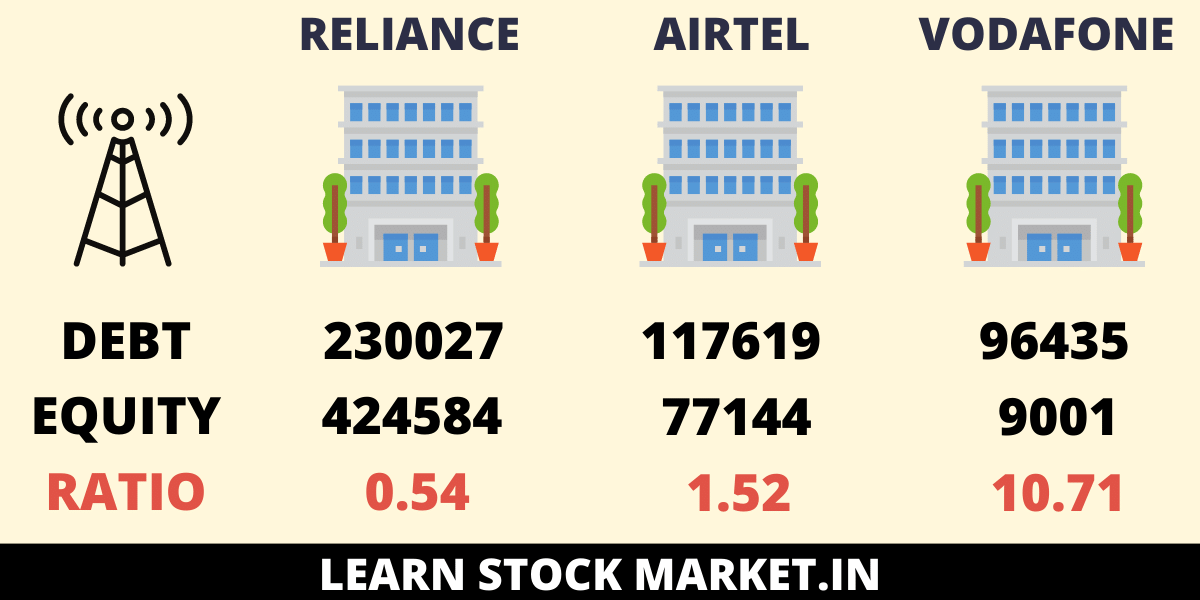

Tax obligations, and trade & other payables have been excluded from the calculation of debt as they constitute non-interest bearing liabilities. Investors often scrutinize the Debt to Equity ratio before making investment decisions. A company with a high ratio might be seen as risky, whereas one with a lower ratio could be viewed as more stable. While it depends on the industry, a D/E ratio below 1 is often seen as favorable. Ratios above 2 could signal that the company is heavily leveraged and might be at risk in economic downturns. As established, a high D/E ratio points to a company that is more dependent on debt than its own capital, while a low D/E ratio indicates greater use of internal resources and minimal borrowing.

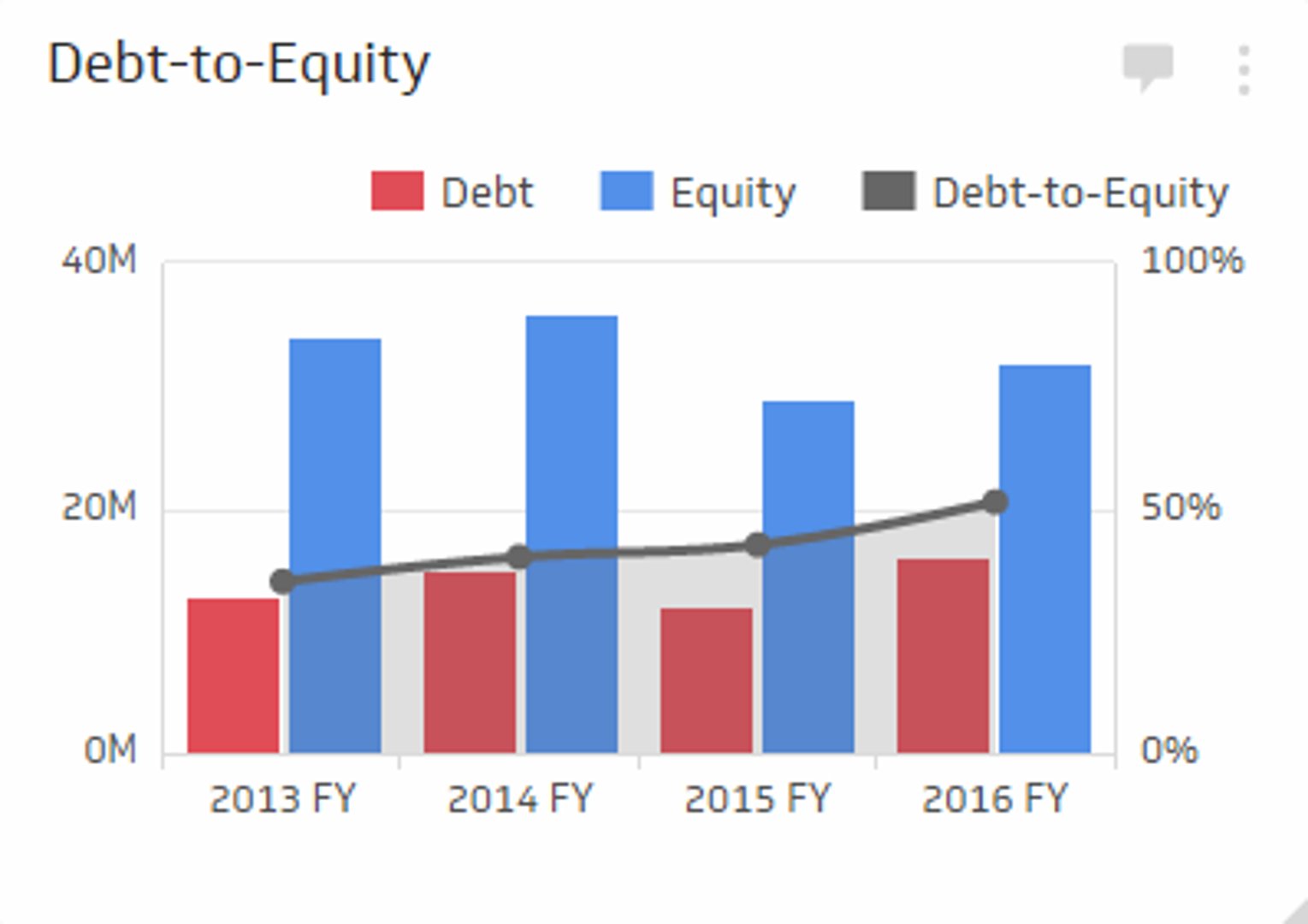

Assessing whether a D/E ratio is too high or low means viewing it in context, such as comparing to competitors, looking at industry averages, and analyzing cash flow. They do so because they consider this kind of debt to be riskier than short-term debt, which must be repaid in one year or less and is often less expensive than long-term debt. When interpreting the D/E ratio, you always need to put it in context by examining the ratios of competitors and assessing a company’s cash flow trends.

The D/E ratio can be skewed by factors like retained earnings or losses, intangible assets, and pension plan adjustments. Therefore, it’s often necessary to conduct additional analysis to accurately assess how much a company depends on debt. A debt-to-equity ratio of 1.5 would indicate that the company in question has $1.50 of debt for every $1 of equity. To illustrate, suppose the company had assets of $2 million and liabilities of $1.2 million.

“Today, we are witnessing energy companies with strong balance sheets. Management teams have learned the lessons of prior years and have retired a lot of outstanding debt.” Different sectors have varying norms, and it’s essential to compare against industry averages. A challenge in using the D/E ratio is the inconsistency in how analysts define debt. Capital-intensive sectors like manufacturing typically have higher D/E ratios, while industries focused on services and technology often have lower capital and growth requirements, resulting in lower D/E ratios.

The ratio offers insights into the company’s debt level, indicating whether it uses more debt or equity to run its operations. Another popular iteration of the ratio is the long-term-debt-to-equity ratio which uses only long-term debt in the numerator instead of total debt or total liabilities. This second classification of short-term debt is carved out of long-term debt and is reclassified as a current liability called current portion of long-term debt (or a similar name). The remaining long-term debt is used in the numerator of the long-term-debt-to-equity ratio. In a basic sense, Total Debt / Equity is a measure of all of a company’s future obligations on the balance sheet relative to equity. However, the ratio can be more discerning as to what is actually a borrowing, as opposed to other types of obligations that might exist on the balance sheet under the liabilities section.

For companies with steady and consistent cash flow, repaying debt happens rapidly. Also, because they repay debt quickly, these businesses will likely have solid credit, which allows them to borrow inexpensively from lenders. For example, if a company, such as a manufacturer, requires a lot of capital to operate, it may need to take on a lot of debt to finance its operations. Including preferred stock in total debt will increase the D/E ratio and make a company look riskier. Including preferred stock in the equity portion of the D/E ratio will increase the denominator and lower the ratio.