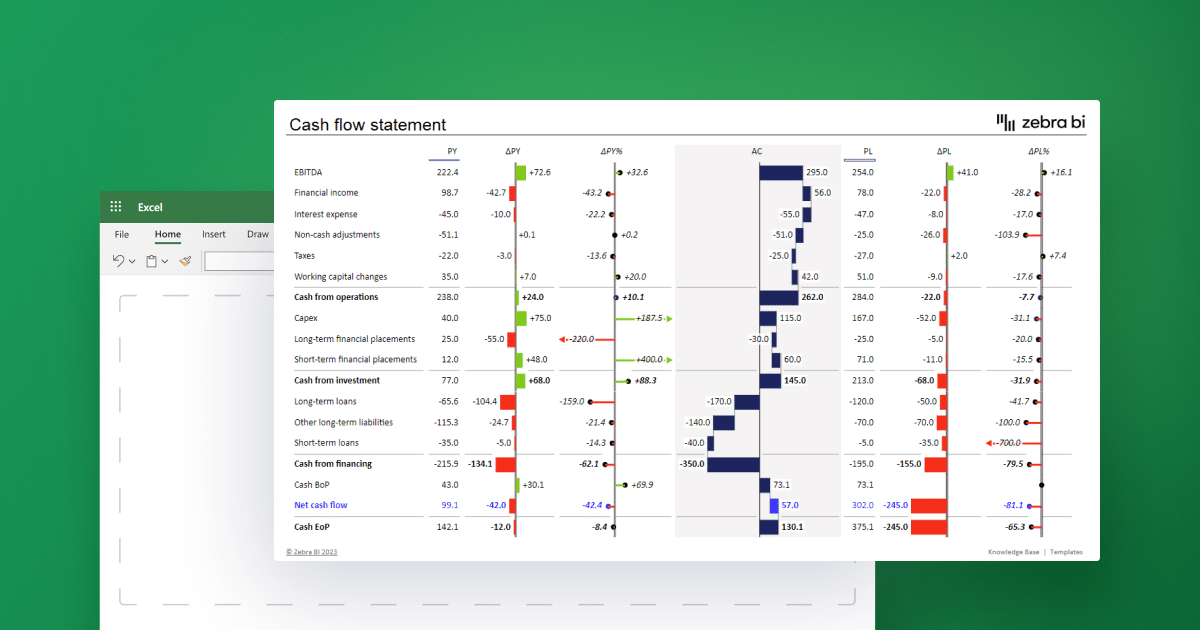

If operating cash flow aligns closely with net income, it indicates that the company’s earnings are primarily cash-based and less dependent on non-cash items like depreciation or accounting adjustments. This alignment suggests more stable and sustainable earnings, which is appealing to long-term investors. Conversely, a large discrepancy between net income and cash flow may raise questions about the company’s accounting practices or reliance on credit sales, signaling potential financial management issues. The change in net cash for the period is equal to the sum of cash flows from operating, investing, and financing activities. This value shows the total amount of cash a company gained or lost during the reporting period. A positive net cash flow indicates a company had more cash flowing into it than out of it, while a negative net cash flow indicates it spent more than it earned.

What is the approximate value of your cash savings and other investments?

LO 16.4Use the following excerpts from SternCompany’s financial information to prepare a statement of cashflows (indirect method) for the year 2018. LO 16.4Use the following excerpts from TungstenCompany’s financial information to prepare a statement of cashflows (indirect method) for the year 2018. LO 16.4Use the following excerpts from WickhamCompany’s financial information to prepare a statement of cashflows (indirect method) for the year 2018. LO 16.4Use the following excerpts from YardleyCompany’s financial information to prepare a statement of cashflows (indirect method) for the year 2018. LO 16.4Use the following excerpts from ZowleskiCompany’s financial information to prepare a statement of cashflows (indirect method) for the year 2018. This cash flow statement is for a reporting period that ended on Sept. 28, 2019.

How to Analyze & Prepare a Cash Flow Statement Like a Pro

While each company will have its own unique line items, the general setup is usually the same. From the following balance sheet of Star Mills Ltd., prepare a cash flow statement. It focuses on the speed of cash being collected from debtors, stock, and other current assets, as well as the use of cash in paying current liabilities. Operating cash flows are calculated by adjusting net income by the changes in current asset and liability accounts.

What are the three types of Cash Flows?

- Operating cash flows are calculated by adjusting net income by the changes in current asset and liability accounts.

- That gets added back here because the sale proceeds of an asset include the cost as well as the gain on the sale of the asset.

- As a result, the business has a total of $126,475 in net cash flow at the end of the year.

- As a result, D&A are expenses that allocate the cost of an asset over its useful life.

Non-cash expenses (expenses that don’t involve cash outflow) like depreciation and amortization must be added back to the net income. By comparing cash as reported on a current balance sheet with cash as reported on the balance sheet at the end of the preceding year, we can see how much cash changed—but not why it changed. Understanding how to create, interpret, and effectively use financial statements is pivotal for strategic decision-making. Financial statements, particularly, are essential tools that extend beyond simple record-keeping that can guide your business strategy. When using GAAP, this section also includes dividends paid, which may be included in the operating section when using IFRS standards. Interest paid is included in the operating section under GAAP but sometimes in the financing section under IFRS.

Example 3. Analyzing Capital Expenditure and Growth Plans

The change in the liability account is the difference in the expense incurred that is included in net income and cash actually paid for the expense this period. You received the following information from Hema Enterprises Pvt. From the summarized cash book of Zenith Ltd. shown below, calculate net cash flow from operating activities. These problems will help students clarify key concepts about cash flow statements and to ready themselves for their exams and interviews.

Company A – Statement of Cash Flows (Alternative Version)

Issuance of equity is an additional source of cash, so it’s a cash inflow. This is buying back, through cash payment, the equity from its investors. Conversely, if a current liability, like accounts payable, increases this is considered a cash inflow. This is because the company has yet to pay cash for something it purchased on credit. This increase is then added to net income (a decrease would be subtracted).

LO 16.1Provide journal entries to record each ofthe following transactions. For each, identify whether thetransaction represents a source of cash (S), a use of cash (U), orneither (N). We also allow you to split your payment across 2 separate credit card transactions or send a payment link email to another person on your behalf. If splitting your payment into 2 transactions, a minimum payment of $350 is required for the first transaction. Our easy online application is free, and no special documentation is required.

Some candidates may qualify for scholarships or financial aid, which will be credited against the Program Fee once eligibility is determined. Please refer to the Payment & Financial Aid page for further information. The ending balances of the balance sheet accounts is not useful information. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

LO 16.3Use the following excerpts from LeopardCompany’s financial records to determine net cash flows frominvesting activities. LO 16.3Use the following excerpts from FruitcakeCompany’s financial records to determine net cash flows frominvesting activities. LO 16.3Use the following excerpts from EagleCompany’s financial records to determine net cash flows fromfinancing activities.

LO 16.3Use the following information fromChocolate Company’s financial statements to determine operating netcash flows (indirect method). LO 16.3Use the following information fromAlbuquerque Company’s financial statements depreciation of assets to determine operatingnet cash flows (indirect method). Understanding cash flow statements can help you manage your business’s finances by revealing not just the amounts but also the sources and uses of cash.

LO 16.6Use the following cash transactionsrelating to Warthoff Company to determine the cash flows fromoperating, using the direct method. LO 16.6Use the following cash transactionsrelating to Lucknow Company to determine the cash flows fromoperating, using the direct method. LO 16.6Use the following excerpts from JasperCompany’s financial statements to determine cash paid to suppliersfor inventory in 2018. LO 16.6Use the following excerpts from BrownstoneCompany’s financial statements to determine cash received fromcustomers in 2018. LO 16.5The following shows excerpts from CamoleCompany’s statement of cash flows and other financial records. LO 16.6Use the following excerpts from HuckleberryCompany’s financial statements to determine cash paid to suppliersfor inventory in 2018.