The cash flow statement shows if the company can sustain its operations, grow, and weather financial hiccups. Unlike other financial reports that might focus on profit, the cash flow statement deals purely with actual cash. This makes it an essential tool for understanding if there’s enough cash to pay expenses and fund new projects or if the company needs to bring in more cash from loans or investments. 8) interest expense is part of net income in the operating section of the indirect statement.

Chart of Accounts

For most small businesses, Operating Activities will include most of your cash flow. That’s because operating activities are what you do to get revenue. If you run a pizza shop, it’s the cash you spend on ingredients and labor, and the cash you earn from selling pies. If you’re a registered massage therapist, Operating Activities is where you see your earned cash from giving massages, and the cash you spend on rent and utilities. Now that we’ve got a sense of what a statement of cash flows does and, broadly, how it’s created, let’s check out an example. In our examples below, we’ll use the indirect method of calculating cash flow.

Focus on Growth, Let Synder Handle the Accounting

Accumulated depreciation has no impact to cash and this account is ignored when preparing the financing section. Assume that the change was all in cash ONLY when you have NO other information. While cash is important for all book value per share bvps overview formula example businesses, it’s especially crucial for a high-growth business. If you’re in a high growth phase, your business needs plenty of resources—more employees, better infrastructure, office space—and all of these require cash.

Practice Problems: Statement of Cash Flows

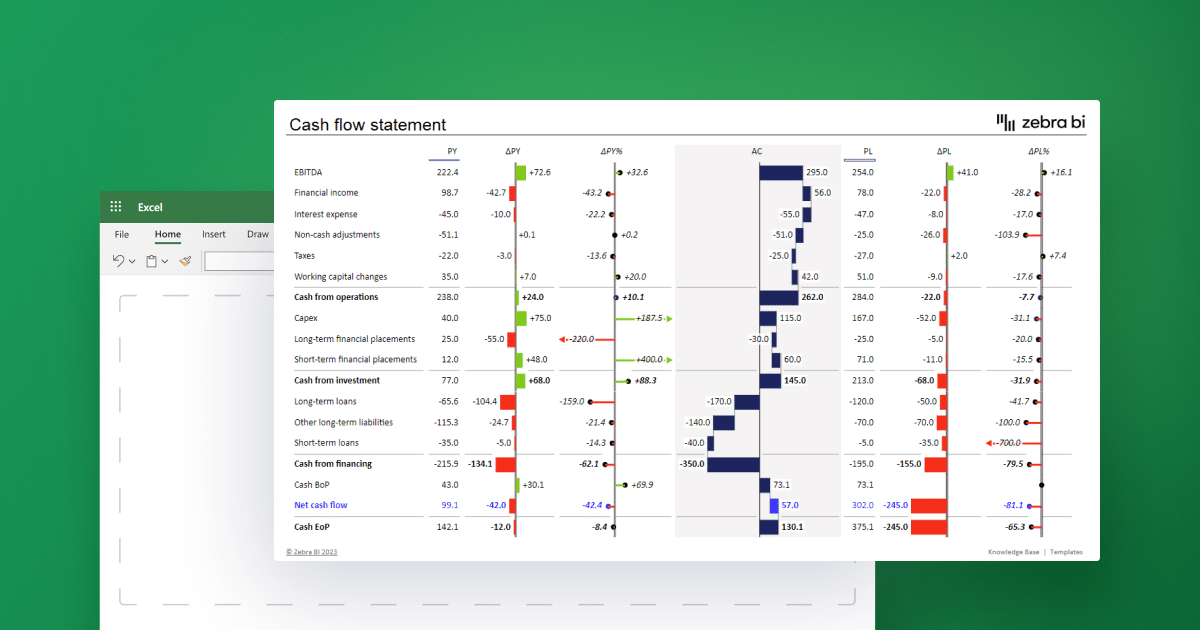

Free cash flow is the available cash after subtracting capital expenditures. The cash flow statement also encourages management to focus on generating cash. Analysts look in this section to see if there are any changes in capital expenditures (CapEx). This section covers revenue earned or assets spent on Financing Activities. When you pay off part of your loan or line of credit, money leaves your bank accounts.

A negative effect could also be thought of as a use of cash, a decrease in cash, or a negative amount on the cash flow statement. Positive cash flow reveals that more cash is coming into the company than going out. This is a good sign as it tells that the company is able to pay off its debts and obligations. Negative cash flow typically shows that more cash is leaving the company than coming in, which can be a reason for concern as the company may not be able to meet its financial obligations in the future.

Statement of Cash Flows

In other words, the financing section on the statement represents the amount of cash collected from issuing stock or taking out loans and the amount of cash disbursed to pay dividends and long-term debt. You can think of financing activities as the ways a company finances its operations either through long-term debt or equity financing. The cash flows from operating activities section provides information on the cash flows from the company’s operations (buying and selling of goods, providing services, etc.). With the most likely used indirect method, the starting point of this section is the company’s net income. It is followed with adjustments to convert the amount of net income from the accrual method to the cash amount.

- Under U.S. GAAP, interest paid and received are always treated as operating cash flows.

- For most small businesses, Operating Activities will include most of your cash flow.

- By examining the cash flow from operating activities, analysts can determine whether a company generates enough cash to cover its short-term obligations.

- In other words, a company with good cash flow can collect enough cash to pay for its operations and fund its debt service without making late payments.

However, this could also mean that a company is investing or expanding which requires it to spend some of its funds. The cash flow statement presents a good overview of the company’s spending because it captures all the cash that comes in and goes out. Consequently, the business ended the year with a positive cash flow of $1.5 million and total cash of $9.88 million. This method of calculating cash flow takes more time since you need to track payments and receipts for every cash transaction. Notes payable is recorded as a $7,500 liability on the balance sheet. Since we received proceeds from the loan, we record it as a $7,500 increase to cash on hand.

While the indirect cash flow method makes adjustments on net income to account for accrual transactions. A cash flow statement tells you how much cash is entering and leaving your business in a given period. It gives predictive value of future cash flows based on the past cash flows.

Positive cash flow from operating activities indicates that the company is generating sufficient cash to sustain its day-to-day operations, which is essential for long-term viability. In studying “Analyzing Statements of Cash Flows I” for the CFA, you should aim to understand the components and purpose of cash flow statements, focusing on their role in financial analysis. Learn how cash flows from operating, investing, and financing activities provide insights into a company’s financial health. Explore the impact of non-cash adjustments, such as depreciation and amortization, on operating cash flow, and examine how changes in working capital reflect operational efficiency.