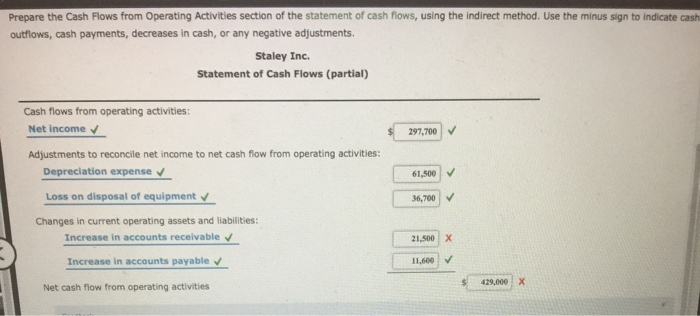

It may be prepared in one of two ways, using either the indirect or the direct method. Although information presented in the operating activities section is different, both methods yield the same cash flows from operating activities amount. The indirect method is more popular loss on sale of equipment cash flow because the information needed to prepare the section is readily available on the income statement and balance sheet. The choice of methods pertains only to the operating activities section. The investing and financing section both are prepared using a direct method.

3: Prepare the Statement of Cash Flows Using the Indirect Method

Therefore, the income statement and comparative balance sheet numbers will be used to efficiently remove non-cash transactions in order to arrive at the net cash flow from operating activities number. We will use the current assets (other than cash) and the current liabilities (other than the notes payable – bank which we will report in financing). Remember, we ADD decreases and SUBTRACT increases in current assets but in current liabilities we will ADD increases and SUBTRACT decreases. Propensity Company had a decrease of $1,800 in the current operating liability for accounts payable.

3 Prepare the Statement of Cash Flows Using the Indirect Method

If the underlying fixed asset makes a profit, it will increase net income or reduce net losses. On the other hand, a fixed asset sold for a loss decreases net income or increases net losses. Assume that you are the chief financial officer of a company that provides accounting services to small businesses. Further assume that there were no investing or financing transactions, and no depreciation expense for 2018. Propensity Company had an increase in the current operating liability for salaries payable, in the amount of $400. The payable arises, or increases, when an expense is recorded but the balance due is not paid at that time.

Disposal of Assets – Sale of Asset AccountingCoach

Its cost can be covered by several forms of payment combined, such as a trade-in allowance + cash + a note payable. When a fixed asset that does not have a residual value is fully depreciated, its cost equals its Accumulated Depreciation balance and its book value is zero. Under the direct method, the information contained in the company’s accounting records is used to calculate the net CFO.

- Consequently, companies can include the sales proceeds in the cash flow statement.

- Companies may add other expenses and losses back to net income because they do not actually use company cash in addition to depreciation.

- This would impact the cash flows from investing activities section since there would be an additional cash receipt.

- The gain (loss) component is recognized in the operating activities and the proceeds component is recognized in the investing activities section.

The company breaks even on the disposal of a fixed asset if the cash or trade-in allowance received is equal to the book value. It also breaks even of an asset with no remaining book value is discarded and nothing is received in return. A company may no longer need a fixed asset that it owns, or an asset may have become obsolete or inefficient. Prior to discussing disposals, the concepts of gain and loss need to be clarified.

Financing Activities Leading to a Decrease in Cash

Consequently, companies can remove the profits or losses recorded in the income statement. This adjustment occurs under the cash flow from operating activities. The above treatment falls under the cash flows from the operating activities section in the cash flow statement. Once companies remove the impact of profits or losses from selling fixed assets, they can move toward investing activities. Since fixed assets are a part of those, the sale proceeds will fall under this section.

The most common example of an operating expense that does not affect cash is depreciation expense. The journal entry to record depreciation debits an expense account and credits an accumulated depreciation account. This transaction has no effect on cash and, therefore, should not be included when measuring cash from operations. Because accountants deduct depreciation in computing net income, net income understates cash from operations. Under the indirect method, since net income is a starting point in measuring cash flows from operating activities, depreciation expense must be added back to net income. Because the current liability rule states that decreases in current liabilities are deducted from net income, $9,000 is deducted from net income in the operating activities section of the statement of cash flows.

Take note the equipment purchase is deducted and tagged as “net cash outflow.” Paying cash is an outflow, and receiving cash is an inflow. The investments cost $80,000 (given on the balance sheet) and there was a gain of $10,000 when they were sold (given on the income statement). The land cost $100,000 (given on the balance sheet) and there was a loss of $1,000 when it was sold (given on the income statement). In the case of Propensity Company, the decreases in cash resulted from notes payable principal repayments and cash dividend payments. Transactions that do not affect cash but do affect long-term assets, long-term debt, and/or equity are disclosed, either as a notation at the bottom of the statement of cash flow, or in the notes to the financial statements. In the case of Propensity Company, the decreases incash resulted from notes payable principal repayments and cashdividend payments.

This article is focused on the indirect method of preparing the operating activities section of the statement of cash flows. If you are looking for the direct method, please read the “operating activities section by direct method” article. By fiscal year ended June 30, 2004, Microsoft was sitting on more than $60,000,000,000 in cash and short-term investments.

11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links.

And during the accounting period, we charged a $50,000 depreciation expense to the income statement and we also had a $10,000 gains on the disposal of fixed assets transaction during the period. Propensity Company had a decrease of $4,500 in accounts receivable during the period, which normally results only when customers pay the balance, they owe the company at a faster rate than they charge new account balances. Thus, the decrease in receivable identifies that more cash was collected than was reported as revenue on the income statement. Thus, an addback is necessary to calculate the cash flow from operating activities. The operating section of the cash flow statement is not a report of the direct cash inflows and outflows.