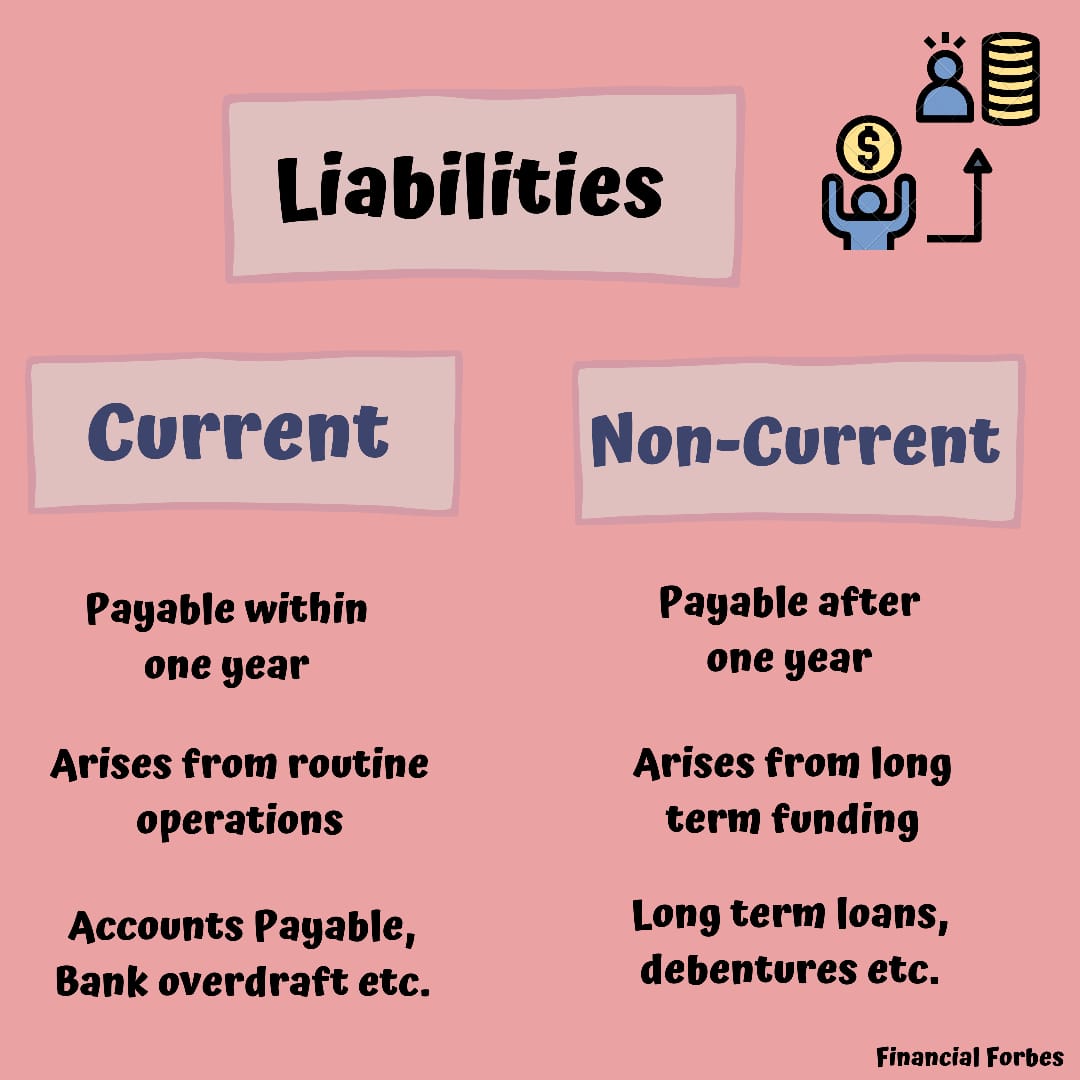

They’re any debts or obligations that your business has incurred that are due in over a year. Businesses will take on long-term debt to acquire new capital to purchase capital assets or invest in new capital projects. Businesses routinely pay current liabilities during their standard day-to-day operations. The largest debts owed within this category tend to be accounts payable.

What is a Liability Account? – Definition

Long-term liabilities have higher interest rates due to the wide gap between the time of borrowing and repayment. A contingent liability is recorded as a current liability on an event of its occurrence. Lenders take contingent liabilities into account to determine the financial state of the company.

The debt to capital ratio

In isolation, total liabilities serve little purpose, other than to potentially compare how a company’s obligations stack up against a competitor operating in the same sector. For instance, assume a retailer collects sales tax for every sale it makes during the month. The sales tax collected does not have to be liabilities examples remitted to the state until the 15th of the following month when the sales tax returns are due. If the company does not remit the sales tax at the end of the month, it would record a liability until the taxes are paid. The sales tax expense is considered a liability because the company owed the state the money.

Other Definitions of a Liability

Making sure that you’re paying off your debts regularly will help reduce your overall business liabilities. A person or business can also be held liable from a legal standpoint; therefore, liability insurance is frequently purchased as a form of financial protection. Both individuals and businesses benefit when maximizing assets and minimizing liabilities. Taxes and rent or mortgage payments are often the largest liability of an individual or household. The terms borrowed, owed, or obligated are good indications that a liability relationship exists among individuals, companies, or governments. Assets, liabilities, and equity are reported on a balance sheet utilizing what is commonly referred to as The Accounting Equation.

- Recognizing liabilities in the balance sheet can be tricky and a confusing bookkeeping responsibility.

- Both balance sheet and income statements are types of financial statements.

- Read on to learn more about the importance of liabilities, the different types, and their placement on your balance sheet.

- Long-term liabilities are debts that take longer than a year to repay, including deferred current liabilities.

- Liabilities are listed on a company’s balance sheet and expenses are listed on a company’s income statement.

For example, a supplier might offer terms of “3%, 30, net 31,” which means a company gets a 3% discount for paying 30 days or before and owes the full amount 31 days or later. The treatment of current liabilities for each company can vary based on the sector or industry. Current liabilities are used by analysts, accountants, and investors to gauge how well a company can meet its short-term financial obligations. Below, we’ll provide a listing and examples of some of the most common current liabilities found on company balance sheets. There are a small number of contra liability accounts that are paired with and offset regular liability accounts. One of the few examples of a contra liability account is the discount on bonds payable (or notes payable) account.

Expenses include utility expenses, interest paid, purchases of supplies or materials, or payments for services such as maintenance or deliveries. People have liabilities, as do most investment entities such as funds, partnerships, and corporations. Examples of current liabilities include short-term loans, accounts payable, income taxes payable, dividends payable, accrued expenses, customer deposits, and notes payable. Current liabilities can include things like accounts payable, accrued expenses and unearned revenue.

An example is the possibility of paying damages as a result of an unfavorable court case. The condition is whether the entity will receive a favorable court judgment while the uncertainty pertains to the amount of damages to be paid if the entity receives an unfavorable court judgment. These obligations may arise due to specific situations and conditions. There are three primary classifications when it comes to liabilities for your business.

For example, let’s say that two companies in the same industry might have the same amount of total debt. In short, a company needs to generate enough revenue and cash in the short term to cover its current liabilities. As a result, many financial ratios use current liabilities in their calculations to determine how well or how long a company is paying them down. Liabilities are any debts your company has, whether it’s bank loans, mortgages, unpaid bills, IOUs, or any other sum of money that you owe someone else. If you’ve promised to pay someone a sum of money in the future and haven’t paid them yet, that’s a liability. AT&T clearly defines its bank debt that’s maturing in less than one year under current liabilities.