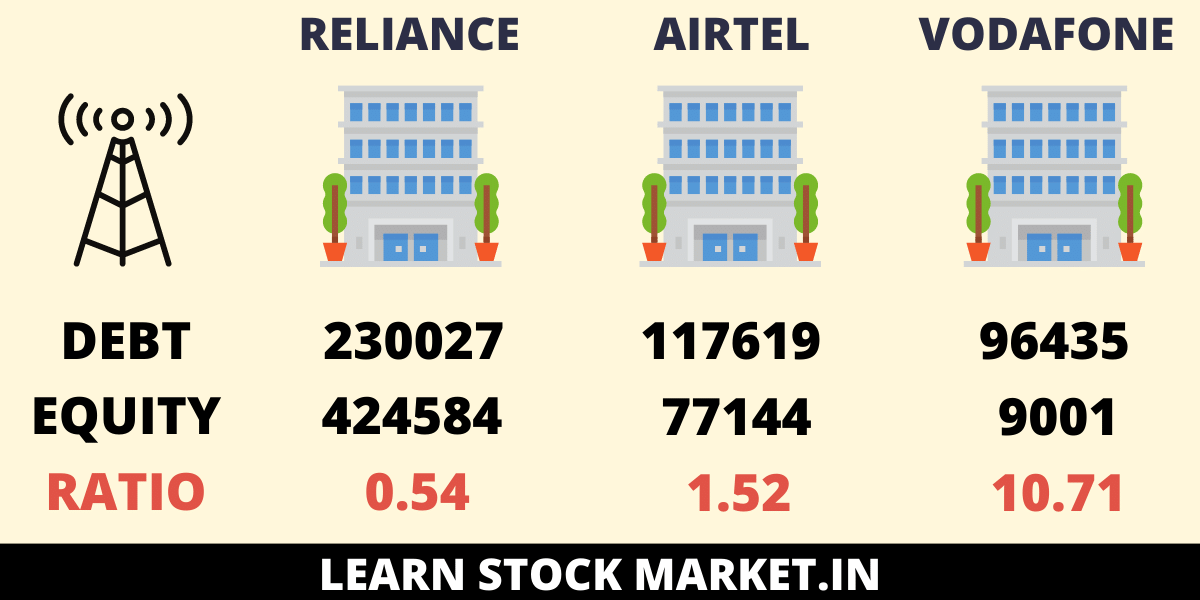

Capital-intensive sectors, such as utilities and manufacturing, often have higher ratios due to the need for significant upfront investment. In contrast, industries like technology or services, which require less capital, tend to have lower D/E ratios. Generally, a ratio below 1 is considered safer, while a ratio above 2 might indicate higher financial risk. Conversely, a low D/E ratio suggests that a company has ample shareholders’ equity, reducing the need to rely on debt for its operational needs.

Excel Formula for Debt-to-Equity Ratio

If preferred stock appears on the debt side of the equation, a company’s debt-to-equity ratio may look riskier. Banks and other lenders keep tabs on what healthy debt-to-equity ratios look like in a given industry. A debt-to-equity ratio that seems too high, especially compared to a company’s peers, might signal to potential lenders that the company isn’t in a good position to repay the debt.

- Lack of performance might also be the reason why the company is seeking out extra debt financing.

- Below is an overview of the debt-to-equity ratio, including how to calculate and use it.

- When making comparisons between companies in the same industry, a high D/E ratio indicates a heavier reliance on debt.

Step 2: Identify Total Shareholders’ Equity

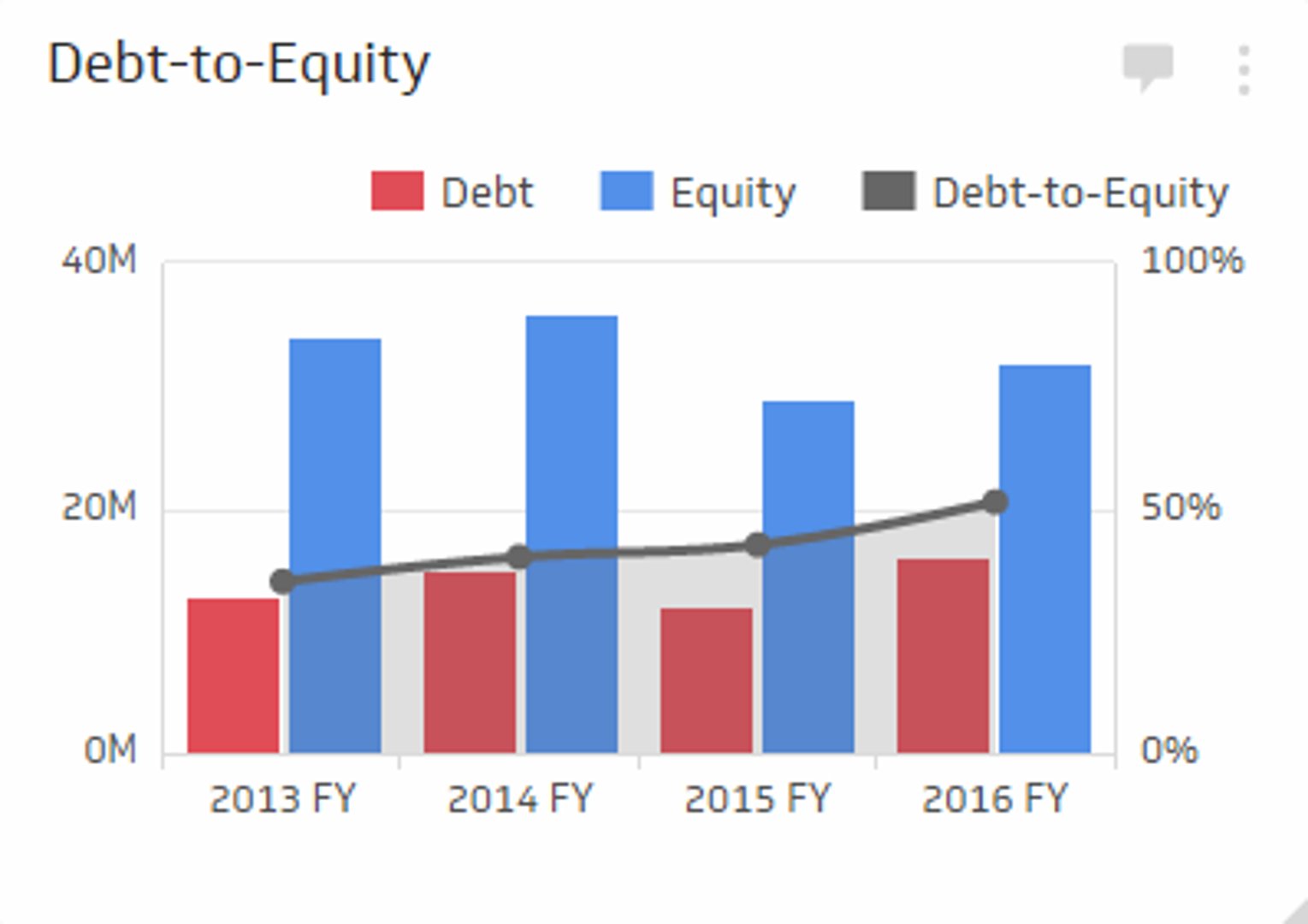

Of note, there is no “ideal” D/E ratio, though investors generally like it to be below about 2. From Year 1 to Year 5, the D/E ratio increases each year until reaching 1.0x in the final projection period. You can invest in stocks, exchange-traded funds (ETFs), mutual funds, alternative funds, and more. SoFi doesn’t charge commissions, but other fees apply (full fee disclosure here).

Which of these is most important for your financial advisor to have?

When debt-to-equity ratio falls outside an acceptable range, a corrective action may be required by companies (e.g. inject more equity), investors (e.g. disinvestment) or lenders (e.g. discontinue further lending). Each variant of the ratio provides similar insights regarding the financial risk of the company. As with other ratios, you pitching must compare the same variant of the ratio to ensure consistency and comparability of the analysis. In nutrition science, there’s a theory of metabolic typing that determines what type of macronutrient – protein, fat, carbs or a mix – you run best on. It can tell you what type of funding – debt or equity – a business primarily runs on.

Effect of Debt-to-Equity Ratio on Stock Price

The investor will then participate in the company’s profits (or losses) and will expect to receive a return on their investment for as long as they hold the stock. Banks often have high D/E ratios because they borrow capital, which they loan to customers. Investors may become dissatisfied with the lack of investment or they may demand a share of that cash in the form of dividend payments. At first glance, this may seem good — after all, the company does not need to worry about paying creditors.

What is your current financial priority?

For this reason, it’s important to understand the norms for the industries you’re looking to invest in, and, as above, dig into the larger context when assessing the D/E ratio. Airlines, as well as oil and gas refinement companies, are also capital-intensive and also usually have high D/E ratios. It’s also helpful to analyze the trends of the company’s cash flow from year to year. It’s clear that Restoration Hardware relies on debt to fund its operations to a much greater extent than Ethan Allen, though this is not necessarily a bad thing.

To get a clearer picture and facilitate comparisons, analysts and investors will often modify the D/E ratio. They also assess the D/E ratio in the context of short-term leverage ratios, profitability, and growth expectations. Debt-to-equity ratio quantifies the proportion of finance attributable to debt and equity. All current liabilities have been excluded from the calculation of debt other the $15000 which relates to the long-term loan classified under non-current liabilities.

In the consumer lending and mortgage business, two common debt ratios used to assess a borrower’s ability to repay a loan or mortgage are the gross debt service ratio and the total debt service ratio. It’s great to compare debt ratios across companies; however, capital intensity and debt needs vary widely across sectors. The financial health of a firm may not be accurately represented by comparing debt ratios across industries. Bear in mind how certain industries may necessitate higher debt ratios due to the initial investment needed.

For example, utilities tend to be a highly indebted industry whereas energy was the lowest in the first quarter of 2024. You could also replace the book equity found on the balance sheet with the market value of the company’s equity, called enterprise value, in the denominator, he says. “The book value is beholden to many accounting principles that might not reflect the company’s actual value.” A high Debt to Equity ratio can lead to increased interest expenses and financial instability. Companies should aim for a balanced ratio to mitigate these risks while leveraging debt for growth. A higher ratio may deter conservative investors, while those with a higher risk tolerance might see it as an opportunity for greater returns.

The long-term D/E ratio for Company A would be 0.8 vs. 0.6 for company B, indicating a higher risk level. As a highly regulated industry making large investments typically at a stable rate of return and generating a steady income stream, utilities borrow heavily and relatively cheaply. High leverage ratios in slow-growth industries with stable income represent an efficient use of capital. Companies in the consumer staples sector tend to have high D/E ratios for similar reasons. Short-term debt also increases a company’s leverage, of course, but because these liabilities must be paid in a year or less, they aren’t as risky.