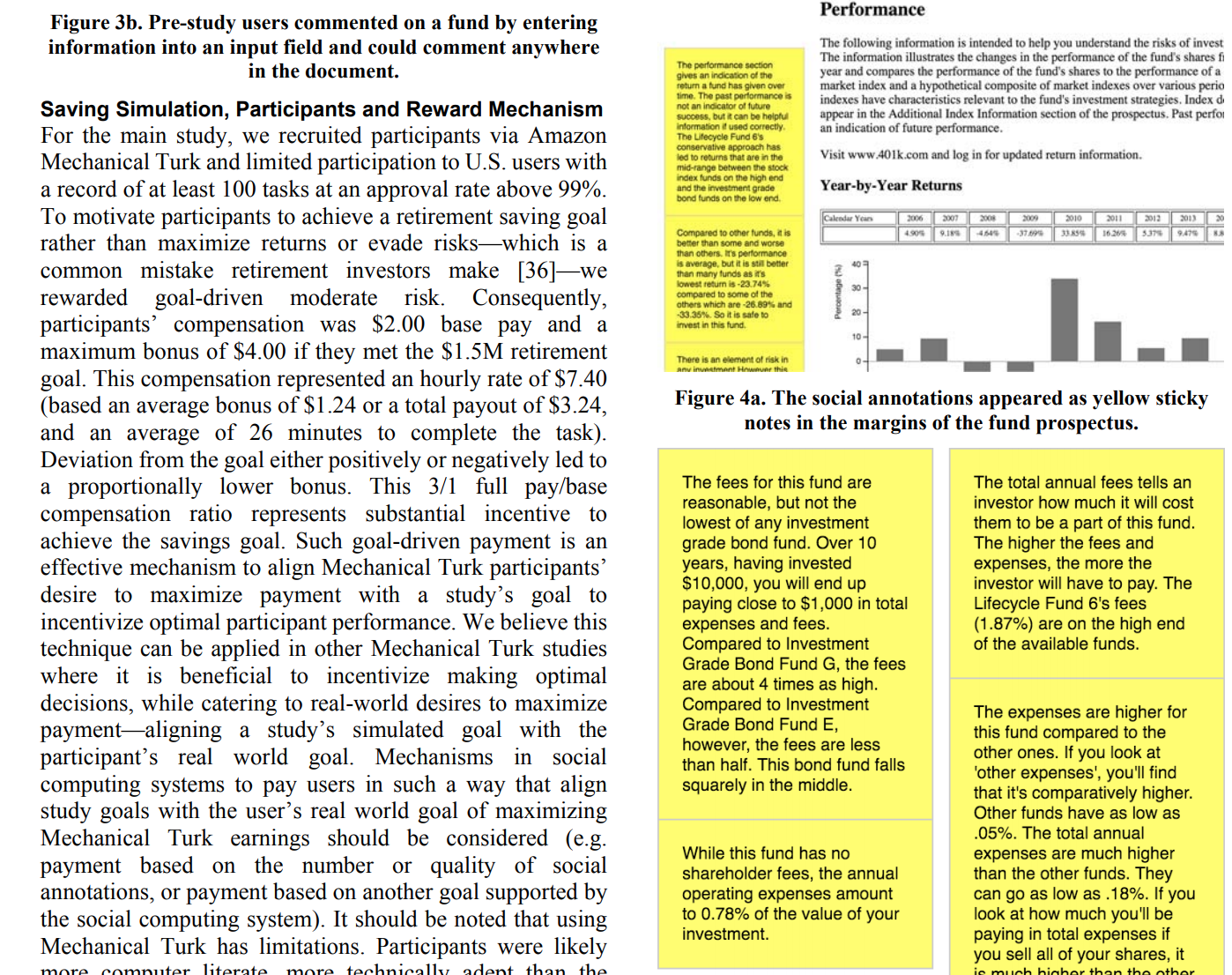

Another article documenting new ways to improve people’s financial decision-making, from Junius Gunaratne, Jeremy Burke, and Oded Nov of NYU and the RAND Corporation: this one “Empowering Investors with Social Annotation When Saving for Retirement.” It profiles one new way to communicate difficult information: digital sticky notes next to the fine print, that give ‘social annotations’ to explain and give examples about the information.

Another article documenting new ways to improve people’s financial decision-making, from Junius Gunaratne, Jeremy Burke, and Oded Nov of NYU and the RAND Corporation: this one “Empowering Investors with Social Annotation When Saving for Retirement.” It profiles one new way to communicate difficult information: digital sticky notes next to the fine print, that give ‘social annotations’ to explain and give examples about the information.

It was published as part of CSCW in 2017.

The abstract:

Financial prospectuses, which are available to consumers who buy financial products, are intended to help inform decision-making. While prospectuses provide a wealth of information, they are complex and difficult to understand for the vast majority of their intended readers. To help nonexperts make informed decisions, we investigated how social annotations with comparative statements embedded into online prospectuses influence users’ decisions and perceptions about decisions. We recruited 31 pre-study users to annotate 10 retirement saving plan prospectuses. We then embedded these annotations in prospectuses provided to another set of 228 users (147 novices and 81 experts) in a 35- period retirement saving simulation. Novices benefited from exposure to social annotations, and were more likely to meet their retirement saving goals than those not exposed to annotations. Exposure to social annotations brought novices’ performance level to that of experts, but at the same time, led them to lower perceived understanding of the prospectus.